Why Full Comprehensive Automotive Coverage For Your Car May Be A Better Option Than PIP Or Liability Coverage Alone

Key Extras of Full Collision and Liability Coverage

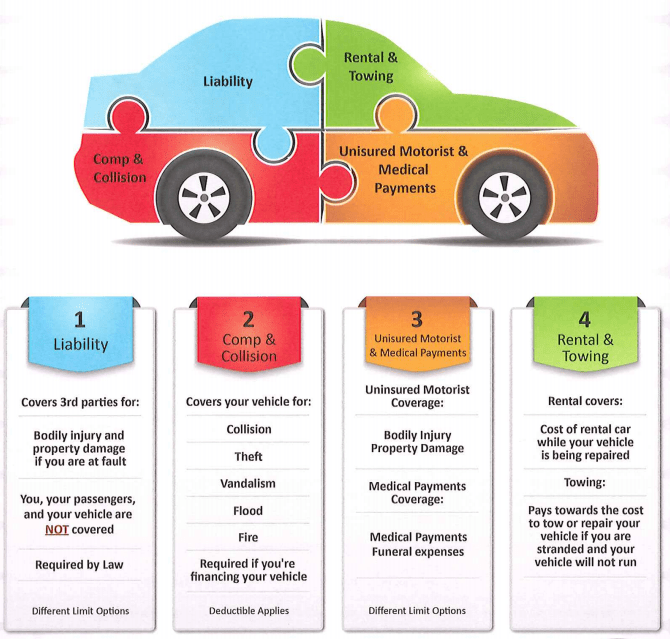

With most full coverage policies or Comprehensive Automotive Coverage, if you have an accident, other than the deductible you chose, you have peace of mind. From the tow truck, to dealing with the repair shop to making sure the paint and trim work is up to factory standards, your insurance can help handle the details.

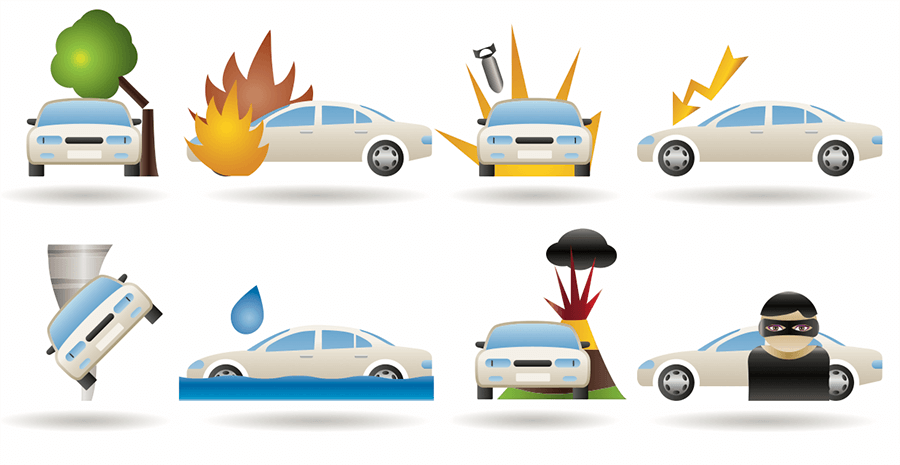

But did you know there are more considerations in most policies that make full coverage much more valuable to you than just collision coverage? Most policies cover hit and run accidents in parking lots and on the street, fire damage from electrical shorts under the hood, weather and “Acts of God” and so much more.

Let’s explore 6 of the key benefits to most Full Coverage Automotive Coverage Policies you may not have considered:

- Pays to repair damage from collisions with animals on the road: This is an example of where Comprehensive Automotive Coverage helps. If you hit a deer in the middle of a snow storm, this is not an “auto accident” unless another a vehicle is involved. Your comprehensive or full coverage will help cover you, your passengers, your car and your property as well as damage to anything your automobile may hit on the side of the road as a result. PIP will not, obviously.

- Full Comprehensive Automotive Coverage pays to replace your car if it is stolen, in some cases, rents you a car while you look for a replacement: Could you replace your car today if it were stolen and not returned? It is true that comprehensive insurance only covers the value specified by your plan and the value at the time it is stolen, but it allows you to recover a car now. Conversely you could choose to use the cash to help pay off the remainder on the stolen car and acquire a new one. Additionally, in many cases your insurance will allow for an emergency rental for a reasonable period of time while you replace the stolen car.

- Comprehensive Automotive Coverage will repair or replace your automobile in the case of weather damage or “Acts of God”: In Florida, golf ball-sized hail can happen, and can leave dents all over your car to the point of major or possibly “totaled” condition. If this happens, and you aren’t insured, how would you cover this major expense? Would you drive a pitted car around town? What if it falls into a sink hole or is swiped away by storm water, are you prepared for that loss?

- Comprehensive Automotive Coverage will pay to have your windshield replaced when it catches a road stone or hail damage: You have seen countless ads on TV where the mobile windshield repair van comes to the rescue of a motorist with a broken windshield? They say it’s free, it isn’t free, this is a benefit of your Comprehensive Automotive Coverage known as property damage.

- Many Comprehensive Automotive Coverage Policies cover Flood Damage: Water can destroy your vehicle’s mechanical parts and upholstery — and if there’s enough damage, it could be considered totaled. This is when comprehensive coverage would kick in. Think this is a far-fetched problem? About 20% of flood insurance claims come from areas considered low or moderate risk, according to the National Flood Insurance Program. Even worse, it could happen anywhere you are on vacation, or visiting family and friends. For example, if you drove to and were visiting family in other states during the hurricane or flood, your vehicle could be impacted! Watching your vehicle submerge or wash away would be heartbreaking.

- Comprehensive Automotive Coverage Policies cover fire damage: Roadside car fires are a staple of morning traffic reports, and they’re inevitably accompanied by rubbernecking delays. But if this happens to your car, Comprehensive Automotive Coverage insurance would help pay to replace it.

Comprehensive coverage also pays to repair damage caused by vandalism or falling objects, such as tree branches.

No matter what prompts a comprehensive claim, your insurer will reduce the amount it pays on your claim by your deductible, which typically ranges from $250 to $2,000, depending on the deductible you chose at the time the policy is issued. If you don’t recall what that amount is, check your auto policy’s declarations page. Also, for new purchases, if you are concerned, look at Gap Insurance, this covers the depreciation of the car when you drive it off the lot.

Other Reasons to Have Comprehensive Automotive Coverage Policies

- Your automotive financing will probably require such a policy:

-

- If you have taken a loan against the car, it’s common practice to require full coverage as well to protect the banks collateral.

- If you have a new car or a car that is being financed, most banks will require that you keep full coverage on the vehicle until it is paid off. This makes sense. If something happens to the car, you don’t want to have to continue to make payments on a vehicle that is no longer useful or stolen. The full coverage insurance will protect that from happening in most cases. If you’re in an accident where the car is totaled, the insurance will pay the car off for you, up to your purchased limit.

- Most Comprehensive Automotive Coverage Policies cover anyone legally allowed to drive your car:

-

- Full coverage insurance will cover all drivers who are legally allowed to drive while in your car. If you loan your car to a relative, or even if it’s taken without your permission, the insurance is still on the car. Liability policies usually cover any driver who has permission, but may require you exclude some drivers. An example of this could be if you have a child or younger sibling living at home, you may be required to exclude that person from the policy or pay a higher premium. So, if your teenage brother takes your car one night and something happens, it may not be covered with liability only insurance policies.

- Many Comprehensive Automotive Coverage Policies cover Car Rental Services in some situations:

-

- Many insurance companies will provide a complementary rental or loaner car if your car is expected to take more than 24 hours to repair providing you have full coverage insurance and buying the Rental Car Option is always available. This can be a great benefit. You don’t have to pay out of pocket for transportation to work and other errands while you wait on your car to be repaired. With liability insurance this may be offered but you must review your documents and plan, because you may be paying out of your own pocket.

- Most Comprehensive Automotive Coverage Policies cover expenses for repairs directly to the shop up front:

- With some insurance plans, full coverage policies will pay you up front for the repairs that need to be done. Often, they will send payment directly to the repair shop so you don’t have to worry about whether or not you will have the money to pay them. With many liability insurance plans, any repairs that are covered are usually reimbursed. This means you have to pay up front out of your pocket and wait for the insurance company to cut you a check. Please review your Plan Documents.

Conclusion

As you can see there are many advantages to having Comprehensive Automotive Coverage Policies if you have a newer car. If you have acquired your car on an automotive loan basis, in most cases, you will be required to carry full coverage on the vehicle to protect the lender.

With full coverage you are going to pay higher premiums. If you don’t have a car that is financed or the car is aging, you can consider lower cost alternatives like PIP or just liability. If the value of your car is something that you can replace easily, or if the full coverage premiums add up to more than the car is worth over the course of a year, then there are a lot of considerations to make sure your tragedy doesn’t get more tragic!

At Riles Allen Insurance we are about the long-term relationship, satisfied customers and referrals.