When You Pay Off Your Mortgage There is No Need for Homeowners Insurance Right?

You may think Homeowners Insurance isn’t that important. Think Again!

Do you have adequate homeowners insurance to cover your home, valuables as well as your family and any who visit your property invited or not? If you are like most Americans, your house and/or condo is most likely your largest single financial investment. It may be the centerpiece of your retirement plan, but what if it vanished? Your home is vulnerable to so many risks, the obvious here in Florida – brutal storms, flooding, torrential rains, and excessive wind. Then are the lesser thought of risks – liability from injuries, vandalism, catastrophic insect damage, robbery, fire and so many other lurking dangers.

When you go to a lender for a mortgage, you are required to carry a set amount of homeowners insurance to protect the mortgage holder. Often times when that mortgage is paid off, we have a mortgage burning party and may consider canceling that homeowners policy as well. There is no law in Florida saying you must carry homeowners insurance on a home you own outright, but a home without homeowners insurance is like keeping all your cash in a wall safe, instead of an insured financial instrument.

- We all know that a good homeowners insurance policy rebuilds your roof or more in case of disaster. But the policy also covers carpet, wallboards, furnishings, belongings and even appliances that may have been destroyed in a disaster. But many policies go way beyond this. For example, where are you going to stay if your house needs significant repair or needs to be re-built? A lesser-known coverage included in many policies covers additional living expenses known as ALE. This coverage will pay for part of all of the lodging and meals while you are forced to move out of your home until repairs are completed after a covered disaster. Hope you never need this clause, but make sure you have it, it can be the difference between financial headaches and a budding recovery.

- There are 3 base types of homeowners insurance available in Florida, and each option must have an additional rider for flooding. A) HO-3 policy gives open perils coverage. That is an insurance industry term that means it protects you against all disasters, except any that are specifically excluded in the policy. (Theft, Fire, Tornadoes are examples of perils). Though the HO-3 Policy insures your personal belongings, it only gives you coverage for the named perils coverage for them, in other words, it sets limits per type of disaster. If the damage happens from a “disaster” not listed in the policy, such as flooding or hurricane, you are not covered. B) An HO-5 gives open perils coverage for both your home’s structure and personal property. Though it costs more, and may not be offered by every insurance company, it is probably worth the difference in the long run. C) An HO-6 policy covers condo or co-op owners and involves the structural parts of the building that you own or control against named disasters in the policy. For example, in a high-rise, the association insurance covers the building, plumbing, and electric, but your policy covers the wallboard and flooring in your unit. Most HO-6 policies also cover personal property contained within the unit, theft fire water damage, much like the HO-5.

- Homeowners insurance policies usually will have options for the amount of coverage you receive, minus the deductible you choose, when you make a claim against the policy. A) Actual Cash Value Coverage; This policy pays to repair or replace your property and possessions up to the policy limits, minus a deduction for depreciation and age. This is referred to as Market Value Coverage and is the least expensive homeowners insurance option. This type of policy will usually not pay out enough to fully rebuild your home or replace personal items after a serious disaster, but it is the budget option. B) Replacement Cost Coverage; This policy pays to repair or replace property or possessions regardless of age up to policy limits and minus a deductible. This policy costs a bit more, but you will come out of a disaster with a home and furnishings replaced minus your deductible.

- When pricing homeowners insurance you will be asked the value of your home on the market today. Homeowners coverage limits include the value of the main home building and outbuildings, docks and other actual structures. Make sure to discuss your property, home, contents, vehicles, structures, etc, as well as collectibles, jewelry, etc. to set appropriate limits and understand any extra coverage you may need with your agent.

- Know what is not covered or will require extra coverage from standard homeowners insurance before disaster strikes, or before you expect to collect on something that is not eligible. A) damage from a leaky faucet that has caused damage over weeks or months may not be covered because you did not keep up with expected maintenance. B) A leak in the roof not fixed for months or even years until catastrophic damage is caused by the long-term leak may not be covered again due to not keeping up with expected regular maintenance. C) Floods caused by groundwater are typically not covered in basic homeowners insurance and must be purchased separately, possibly as a flood insurance rider or from a different carrier if necessary. D) Tornados and Hurricanes are typically covered inland (many carriers do not cover properties next to the ocean), however, in Florida, you typically will have a separate deductible for damage caused by these named storms. Unlike typical homeowners deductible of $500 or $1,000, hurricane deductibles are usually 1% to 5% of a property’s insured value. For instance, if you have dwelling coverage of $200,000 and a 5% hurricane deductible, you’d pay the first $10,000 of damages. E) Other outlier disasters in Florida could include mold and septic tank back up, and they may or may not be covered, depending on the situation, in other words, make sure you have your agent explain how to best protect yourself.

- Items of exceptional value such as jewelry, art, watches, furs, silverware, high-end electronics, and firearms have special limits for theft but usually, are paid when destroyed in your property. But be careful! Collectibles can acquire very high values so you may need to by additional coverage rider, for example, you are in a $100,000 home with $50,000 in property coverage and you have or inherit an expensive item or items. Let’s say you have jewelry worth 10 or 20 thousand, expensive art, a Rolex or guns, get those valuables appraised by a licensed appraiser and submit that form to your agent for a special homeowners rider to cover those exceptional valuables, you may need a separate policy as well. One great advantage of this extra coverage is most policies then cover these valuables when you are at the office, out at a restaurant even on vacation, remember that bad things can happen to anyone at any time, so be prepared.

- Proper and Expected Regular Home Maintenance is Expected in Most Policies – If your roof is rated at 20 years and you have it blown off in a bad storm if the roof is found to be 22 or even 20 years old the entire claim could be denied. Insurance companies expect regular roof inspections, virulent watch for any developing leaks, keeping trees trimmed and away from overhanging roofs and outbuildings. Do not expect that homeowners insurance is a replacement for regular maintenance, homeowners insurance is to help at times of unexpected or unavoidable loss.

- Your Credit Rating Affects the Rate Charged for Most Homeowners Policies – Since most people pay Homeowners insurance within their mortgage payment escrow account, the insurance company considers it a loan, your credit rating affects the interest rate and therefore the size of the payments. You can avoid higher charge if you have less than desirable credit by paying annually in one lump payment, most mortgage companies pay a lump sum to pay the lowest premium. However, it goes a step further, if you have below-average or poor credit, the actual rate on a homeowners policy could be as much as 100% higher. Insurance companies have the right to charge on expected payouts, and on average or statistically, people with poor credit are more likely to file excessive or even false claims. Several states prohibit this practice but Florida is not one of them, so if you have less than perfect credit, you will want to have an agent who represents multiple carriers to shop around. A better suggestion is to keep your credit great or work to improve it prior to buying so you may avoid higher pricing altogether.

- Making a Claim for Small Stuff Might Not Always be Best Option – Insurance is one of the few things we buy and hope we never to have to use. Homeowners insurance is not meant to replace an aging roof with a new one or fix damage caused by the negligence of not removing a dying tree next to the garage. However, when disasters happen, most policies do take care of you and get you back on your feet even if a roof might be a little old or a tree a little untrimmed. But, not only is repairing damage to your home a real hassle, the time and the mess, but many do not realize that simply making an insurance claim can cause your rate to grow higher for years. Insurance companies’ stats show that a homeowner that makes one clime is more likely to make a second and third claim. The insurance company then adjusts the cost of the policy to compensate for that future risk. If you aren’t sure, call your agent and talk it through to avoid unnecessary claims and make a homeowners insurance claim when necessary, we do not suggest not making claims, just to review the necessity with your agent.

- A Dog Can Substantially Increase Homeowners Insurance Rates – Not for the reasons you may think, not for potential damage to the house, but for damage to neighbors and intruders. The average cost of a dog bite is thirty thousand dollars and believe it or not, makeup over 30% of all homeowners liability claims. Large breeds are the most detrimental and include Akita, Boxer, Pit Bull, Rottweiler, Mastiff, Doberman Pinscher, German Shepherd – well you get the idea. Owning one can significantly increase your rate, or even cause you to be an uninsurable risk for the best insurance companies. There is an easy fix, however, review a separate inexpensive umbrella liability policy covering the dog and other possible risks. Typically, you can get a one-million-dollar umbrella for a competitive rate and can help you reduce worries..

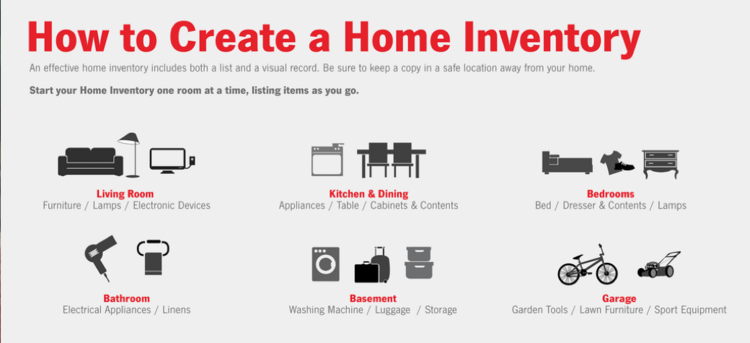

- It is Absolutely Necessary to Create a Detailed Home Inventory – There are many free programs available on-line and apps on the smartphone that can help you make a full inventory of everything of value in your home. Remember the time to try to remember what you had in the home is not after a fire or a devastating storm, it is now. Many parts of claims are denied for insufficient documentation, and there is no excuse with all the free programs available to assist you in the inventory. List everything of value, name model and replacement, (be honest) then take a picture or video with the smartphone or camera to document the items. If you do this and a disaster happens, the claims process will be much smoother. As we stated earlier, any unusually valuable items such as fine jewelry, Rolexes, firs, art, etc., must have a picture and professional appraisal. Finally, store all this information both online (Google Drive is free, for example) and in a secure place out of the house itself (safe deposit box, relative in another state, the office).

- Make Sure Your Agent Looks for Applicable Discounts to Your Policy – Smoke detectors, alarm systems, deadbolts, and upgraded doors, windows, or roofing–you may qualify for discounts, so let your insurer know. Another way to reduce the premium is to accept a higher deductible when you have to use the policy, this can lower the policy considerably. I have also become a recent trend to bundle homeowners and auto insurance for a discount, something else you may want to discuss with your agent.

The most important tip of all is to work with an agent you feel comfortable with, one that has a good reputation and one that you can trust. It is also a good idea that that agent is a non-captive general agent so several policies can be compared from different companies to get you the best rate with the best options. Homeowners insurance seems like an unreasonable expense you may be able to do without until you need it then it can save you and your family’s lifestyle.