Do I Need Personal Liability Insurance if I Have Homeowners Insurance?

Possibly the most important clause within a homeowners policy is the personal liability insurance, or as it is sometimes referred home liability insurance. This section is so important because it covers you and your family members living within the home who are potentially liable for accidents that include bodily injury, property damage, and other items (see your policy or talk to your agent) that occur inside or even outside the insured home that result in.

The personal liability insurance clause within your homeowners insurance policy is so important because it protects your assets and your time in the event someone is injured in your home or due to an accident within your property. An example might be a tree branch falling on a passerby, someone tripping on a cracked sidewalk or in a hole in your yard. This is potentially litigious and especially here in Florida. Lawsuits can come from anywhere. In the house it could be tripping over a folded-up rug, being bitten by your dog, falling through a window, anything is fair game, are you covered?

Personal Liability Insurance is the true lifesaver part of homeowners insurance, even if you are sued for a really “stupid” reason, how much will a lawyer cost to defend the case? What if you lose, will they strip you of everything just from not defending the case? If the “victim” is hospitalized the costs can spin out of control so fast, well you get the idea, I hope. Your coverage can provide immediate assistance with legal guidance and representation as needed. If you have a concern call your agent and they can help determine whether it is nothing, give tips to prepare all the way up to recommending starting a claim with your carrier.

There are Several Kinds of Personal Liability Insurance

- Bodily Injury Coverage; This covers your most likely legal responsibility, when a person (and possibly a pet) is injured, whether due to your negligence or not. It could be a slip and fall on a sidewalk, falling down the stairs in your home or even injuries as a result of a fight on your property, the possibilities are almost endless.

- Medical Payment in conjunction with bodily injury (sometimes called guest medical clause of a homeowners policy) helps pay for reasonable and necessary medical expenses of non-residents who are accidentally injured on or around the property. Personal liability insurance covers claims of injury due to negligence by the property owner as well as lawsuits failed due to an incident on your property.

- The “Guest Medical” clause typically covers (up to policy limits):

- Necessary Medical and Surgical Expense

- Dental Work

- Ambulance

- Hospital Costs

- X-Ray

- Professional Nursing Services

- Prosthetic Devices

- Funeral Services

- Property Damage Coverage; Most personal liability insurance covers the cost of damages to other’s property damaged by a member of your household. An example might be a baseball hit by your child through the neighbor’s plate glass window. The claim would be worth filing if that same baseball went through the window and broke a very valuable piece of art. Property damage coverage would probably pay for both the window and the art piece up to the policy limits. NOTE: Contact your agent to determine if it is worth filing a claim.

Drilling Down, Who and What is Covered by Personal Liability Insurance Within Homeowners Insurance Policies?

In most cases, any family member or persons living within your home are covered by your policy. This would typically include your spouse, children, parents (if they live with you) even employees if they work in your home, however, ask your agent about special considerations for home office situations. Your agent can also help you with questions if you are running a childcare operation that is not a full facility out of your home. You would want to make sure those children visiting your home were fully covered for liability.

This is important to remember, if you rent your home or condo, your renters are not covered by your personal liability insurance. They must attain renter’s insurance if they want to be covered against liability against them, however, the portion of liability that would apply to you is still covered.

Dog bites account for over 400 million dollars of claims per year but are covered by personal liability insurance. As previously noted, however, depending on the type of dog you have, your rate could triple for having certain dogs in the household. This can be circumvented by having a special umbrella policy covering the dog in question, more on this later in this article below.

The biggest area of concern covered by personal liability insurance is a slip and fall. How many times have you heard the ad on TV, well a trip and fall down the stairs or a slip and fall on a slippery sidewalk can not only result in costly medical expenses but turn a friendly neighbor into an adversarial lawsuit looking for damages. Personal liability insurance covers these reasonable expenses.

The strange and odd true accident, like a kid’s baseball going through the neighbor’s window, or a rock thrown by the lawnmower into the neighbor’s car, all covered, even if it is the neighbor’s kid mowing the lawn!

What if your well-intentioned holiday party goes wrong? If your guests get food poisoning, whether you prepared the food, or it was catered, your guests inside your property are covered. There are many considerations to think about, drinking too much, slipping on ice or ranch dressing, etc. There are some restrictions, so be sure to talk to your agent prior to a large event. Regardless, in most cases, you are protected, thanks to personal liability insurance.

Some, but not all homeowners policies will even have personal liability insurance that covers accidents outside of the home in some situations. For instance, if your golf ball goes astray and hits someone in the head, or you run into a table in a hotel lobby with your luggage cart breaking an expensive vase. Ask your agent if things like this may be covered in your policy, and suddenly you can focus on having a good time and not covered legal issues if they arise.

The basic fact is that bad things happen, so when faced with something potentially financially damaging, contact your agent to discuss the circumstances.

What is Not Covered by Personal Liability Insurance when Part of Your Homeowners Policy?

Whether you have homeowners, condo or renter’s insurance, several exclusions from liability are universal. First is that household members including the homeowner themselves cannot claim against the coverage for medical claims. For example, if your family (permanent home residents living under your roof, not renters) slip and fall, that medical claim would go to their health insurance provider or you would have to pay their medical bill. There could be exceptions to this rule, make sure to talk to your agent.

Your vehicle and home are not covered if your family member throws a ball or a rock through your window. If the neighbor’s child threw the ball, or if the neighbor’s lawnmower threw the rock, you have a claim against their homeowners insurance. If you or a family member have damaged your car on your property, you may have a claim against your auto insurance, but not the personal liability insurance portion of your homeowners insurance. A little confusing but your agent can always help review the situation and your policy.

Different homeowners policies have different exclusions of liability, some less expensive policies may exclude the personal liability insurance portion entirely, make sure you have a qualified agent helping you.

Is Personal Liability Insurance Required with a Homeowners Policy?

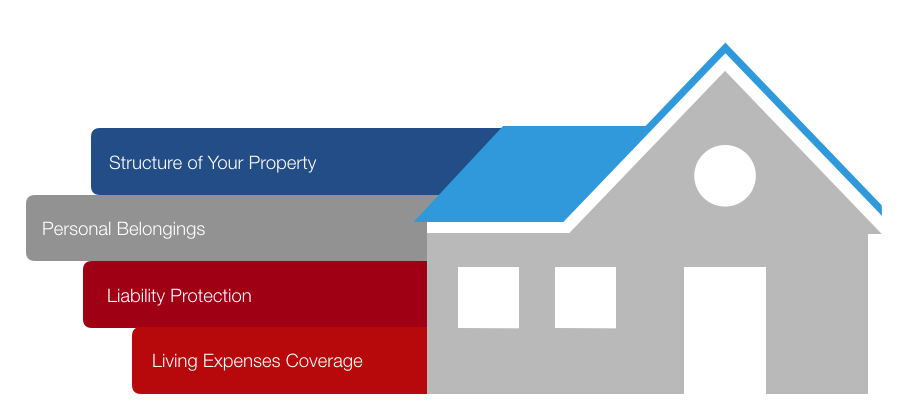

It is theoretically possible to find a homeowners policy without personal liability insurance clause, and liability is not required in most instances if you own your home outright, but the cost would probably not change because of the lack of it. Today it is a standard part of almost any good homeowners policy and is bundled together with other terms into a standard policy.

If you have a mortgage on your home, your lender will require that your homeowners policy contain personal liability insurance to protect their interests. Similarly, a mortgage on a condo will also require personal liability insurance, and it is possible apartment renters will require their tenants have apartment renter insurance for their protection.

Even if you own a condo outright, your condo association probably requires a minimum amount of personal liability insurance. This is because even though the condo association will have liability insurance on the common areas of the condo itself, that policy will not cover the individual units, and if an injury occurs within a unit not covered by personal injury insurance, a lawyer may come after the condo association itself.

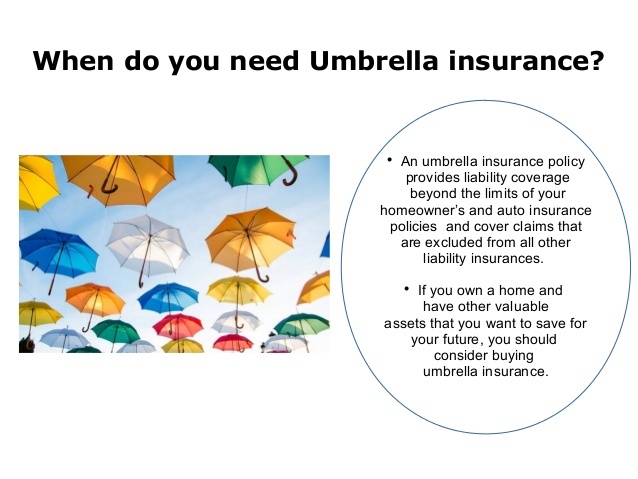

What is a Supplementary Umbrella Policy to Protect Assets Beyond Personal Liability Insurance Limits?

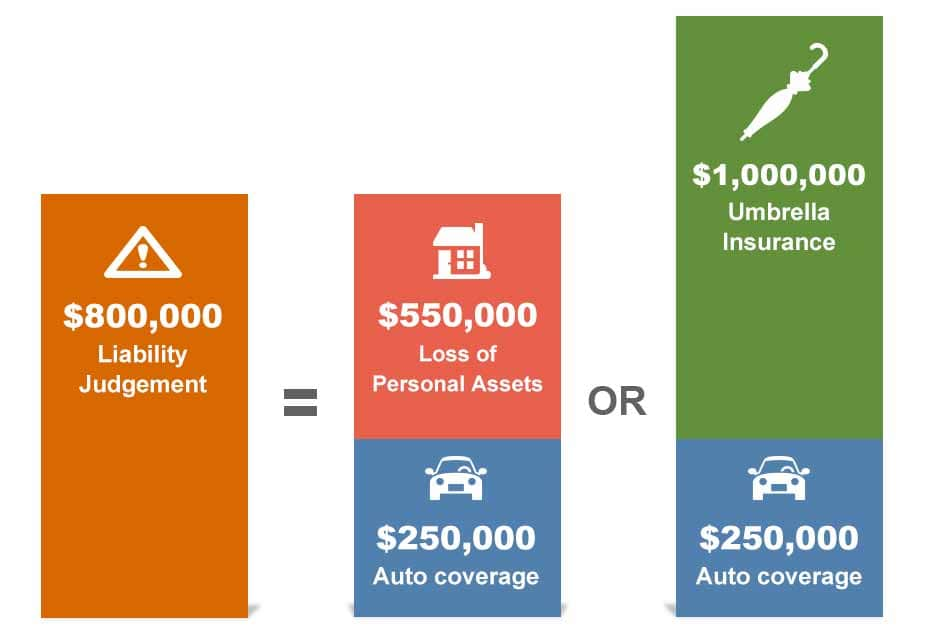

Umbrella Policies are supplemental policies that raise the top limits on the personal liability insurance clauses within home, condo, renters, car insurance, etc. If a policy has, for example, a top liability for a slip and fall of $100,000, an umbrella policy could bring that limit up another 1 million dollars for a relatively inexpensive charge.

People who should be particularly in the market for an umbrella policy are those that are more likely than others to be targets of lawyers. If you have a large house, lots of money and show it, you are a politician, have a business, are known in the community or famous for some reason, you are a potential target.

A large lawsuit and eventual judgment against you could cost you your home, accounts and all other assets up to the point of bankruptcy, including bank accounts or even money for your child’s college to settle a judgment against you that exceeds your policy limits. So, if you are a potential target, all your assets are at risk, that is what umbrella policies guard against.

There is a very comforting aspect to umbrella policies, they are very affordable for the amount of coverage they offer. Even though the cost will vary by personal circumstance and risk, the average cost is about $150.00 to $200.00 per year for 1 million in additional coverage. Your agent can help you determine your need and find an umbrella policy that fits your needs, sometimes a short term policy for an event.

In Conclusion

If you own a home or condo outright or have a mortgage, it would be a big mistake not to have homeowners insurance with personal liability insurance. By the same logic, it would be an even bigger mistake not to check what your personal liability insurance limits are and ensure you are covered for your risk and asset situation. Remember, liability insurance is asset protection, nothing more and nothing less, pure asset protection if you have assets, you need to protect them.

A simple accident that is no fault of yours, but that occurs on your property could cost you every asset you have in a flash. It is a mistake to think it can’t happen to you.

Finally, whether you are relatively wealthy, famous in your field, or just have lawsuit concerns, consider an umbrella supplemental policy. In today’s litigious society, the bigger the target the better the chance you will be sued for the most minor of things. Protect your assets.

If you are considering owning or renting a property, its time to call Riles and Allen Insurance Agency we strongly advise you to consider good quality insurance. Helping you make the best decision for your unique situation is our pleasure!

Call Riles and Allen Insurance Today!!!!

Call Us Today! 407-246-1222