Explain a Homeowners Insurance Rider in Simple Terms?

You have homeowners insurance, But does it protect everything in your home for its full value? Do you need a homeowners insurance rider? Could you provide a proof of loss if you are requested to do so? (fire or theft, for example).

However, your personal property may not be fully covered for its actual value, this is where you might consider a homeowners insurance rider. Homeowners insurance coverage typically comes with limits on overall coverage and for individual items within that coverage. Overall coverage is the maximum amount your policy may reimburse you after a covered loss. Then there are sub-category limits for certain high-value items like jewelry, art and antiques

Let’s say your homeowners insurance policy includes $50,000 top limit in personal property coverage for a total loss like a fire, do you realize there are other limits? Under theft, categories have limits such as jewelry, guns or other collectibles. For example, you may find that a standard homeowners insurance policy provides up to $1,500 in coverage on jewelry for theft. If your wedding ring alone is worth $5,000 what can you do to cover such a catastrophic occurrence? The answer may be a rider. Remember, you need to consider the value of all of your belongings both as individual items for theft and in aggregate for major perils like fire.

So Where Does a Homeowners Insurance Ryder Come in?

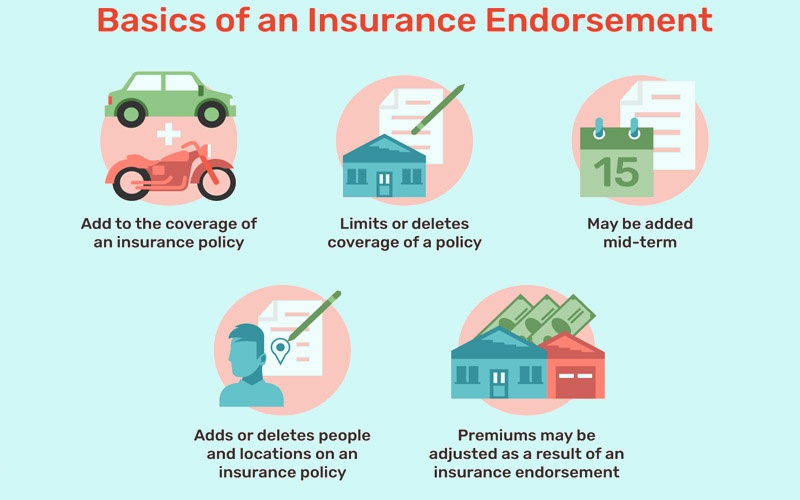

It is instances like those described above that insurance companies offer a rider. A homeowners insurance rider may also be referred to as a floater or an endorsement. A rider is simply an optional add-on to an insurance policy. A common type of rider is called; “scheduled personal property coverage”. This rider provides additional coverage for things you own that are worth more than the per-item limit of your homeowners (or condo or renters) insurance policy. There are also instances where a homeowners insurance rider will provide protection for things that may not be covered at all by a standard policy. For example, a 1997 collectors edition of a Corvette, which is above and beyond Kelly Blue Book because of its rare and collectible nature.

Besides providing higher coverage limits, usually up to the appraised value of the item or items, for certain valuables, you may find that a homeowners insurance rider or scheduled personal property rider helps protect those items from a greater number of risks.

To purchase a homeowners insurance rider or scheduled personal property coverage, you will typically need to provide your insurance company with a recent receipt or a professional appraisal of the item or items. The Insurance Information Institute suggests this to give the insurance company a fair value of the item in advance and you the true value as well, without the emotional attachment. Most homeowners insurance riders need to be listed separately and sometimes require a schedule for each item. For example, a piece of jewelry, or each item category, like an entire coin collection.

Do I Need A Homeowners Insurance Rider; How do I Know When I Need One?

When you inherit a valuable item, become a collector of unusually valuable items or buy something like an expensive engagement ring, it’s a good idea to consider how your insurance policy may help protect it. You may benefit from a rider if you find that certain belongings are worth more than your current coverage limits.

Think about items like:

- Jewelry

- Furs

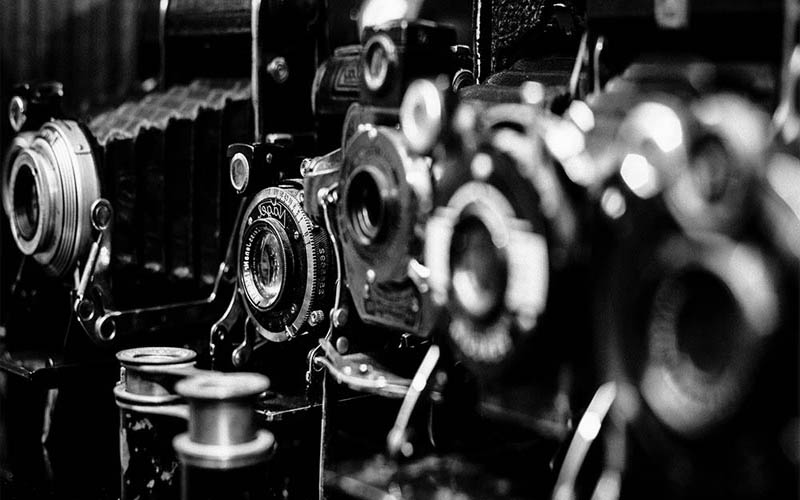

- Expensive Cameras

- Valuable Musical instruments

- Fine art

- Antiques

- Stamp or coin collections

- A collectible car or other vehicles

- Unusual collectibles

If you don’t know how much coverage your policy provides for those types of items, read your policy. Still confused? Contact Riles and Allen Insurance agency, we will help you through it and which items may benefit from a homeowners insurance rider.

What is Proof of Loss in a Homeowners Insurance Rider Claim?

To make a claim with a homeowners insurance rider, proof of loss is often required. This is documentation that proves your ownership of certain items if, for instance, they are stolen and you need to file an insurance claim. Proof of loss helps your insurer verify which of your belongings were damaged or destroyed in a covered claim, and is especially necessary with a homeowners insurance rider. What is more critical is that this documentation is proof of value or how much these items were worth. This assists the insurer in the reimbursement for your lost items faster and adds credibility to your claim of value for those items.

No one expects their home to be broken into, but it’s important to be prepared if and when it happens. A homeowners insurance rider or indeed the policy itself, typically covers personal property, up to the limits stated in the policy or additional value with a rider. To file a claim, you’ll need to know what’s gone and how much each item is worth. Would you be able to list each and every specific item stolen or damaged and how much those items were worth if you came home to a burned out home today? With a homeowners insurance rider, the value is established ahead of time, but you should also be aware of each of these additional covered values.

Do I Need Proof of Loss for an Insurance Claim?

If and when you need to file an insurance claim, your insurer may request a proof of loss or a list of items that have been lost or damaged, including those covered by a homeowners insurance rider. You might be asked to provide some type of proof that you own these items, such as receipts, bills, pictures. videos or appraisals. This is why it may help to think ahead and create a home inventory of your belongings and periodically update it to provide a proof of loss.

How to Create a Home Inventory: CLICK HERE