Small Business Commercial Insurance Risk and Coverage to Address in 2020

Could Your Small Business be at Risk, What to Review?

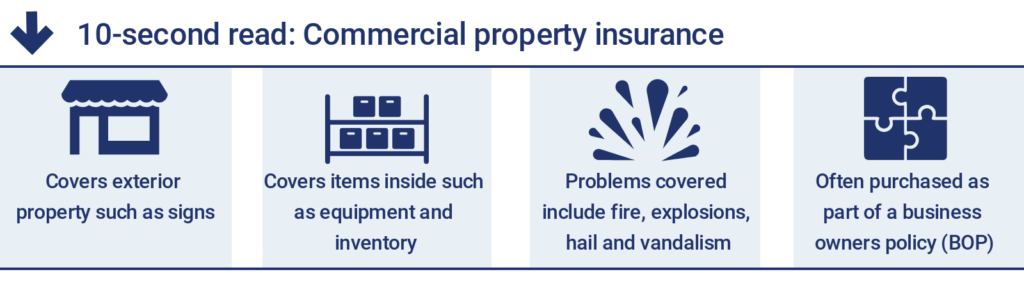

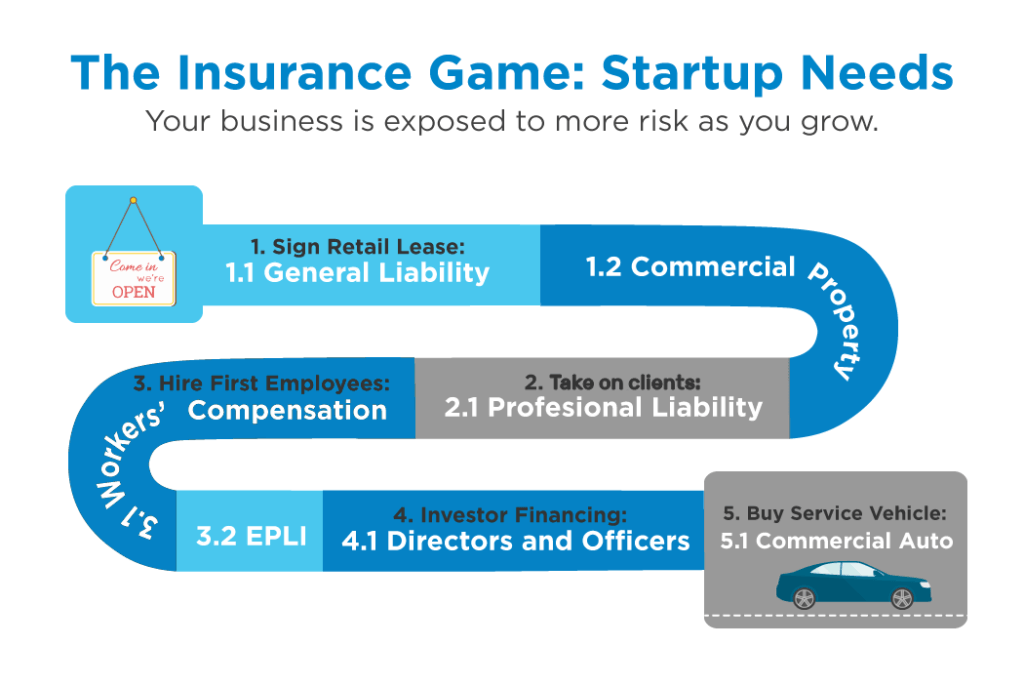

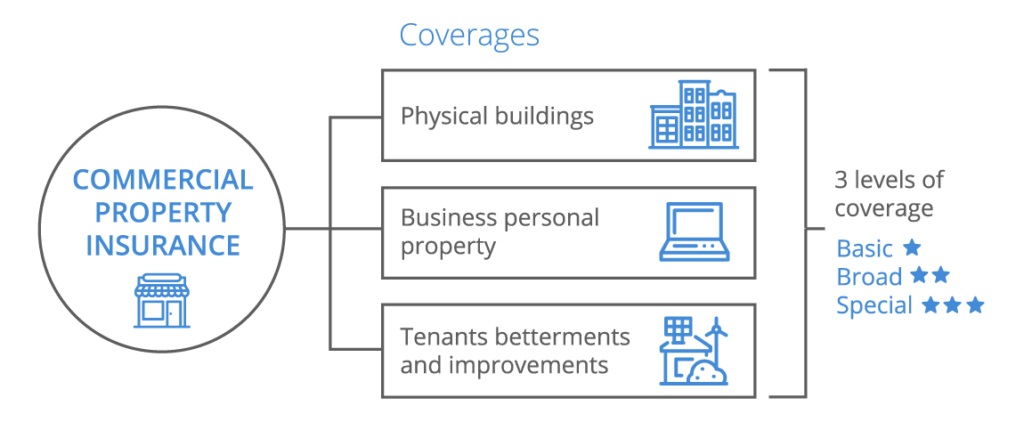

Over the last two years, trending claims and changing rates in the commercial insurance risk and, therefore, the commercial insurance industry make it advisable for all Small Business to review their overall coverage’s. Some of the key areas of concern are commercial property coverage and exposure and risk management procedures for various liabilities within the daily operations of the business. Commercial auto insurance has had a number of challenges for various business due to changes in technology and an improving economy.

-

Commercial Auto Insurance and Commercial Insurance Risk– If you have company cars which the company insures for top management, or your insure a fleet of delivery or workday trucks, there are new concerns to be addressed in 2020. In the last year commercial auto losses and claims have let to new challenges for ensuring that your Commercial Auto Insurance covers any eventuality and exposures to various risks.

These changes to insurance policy coverages are due to emerging factors in the rise, such as the overall frequency of claims in this area. The factors affecting coverage include: advancements in technology, changing social trends and improvements in the economy.

Small Businesses must be proactive and manage the insured risks that arise by promoting fleet safety, adopting the use of “telemetric data (technology installed in each vehicle to monitor drivers’ individual behavior) and changing social trends.

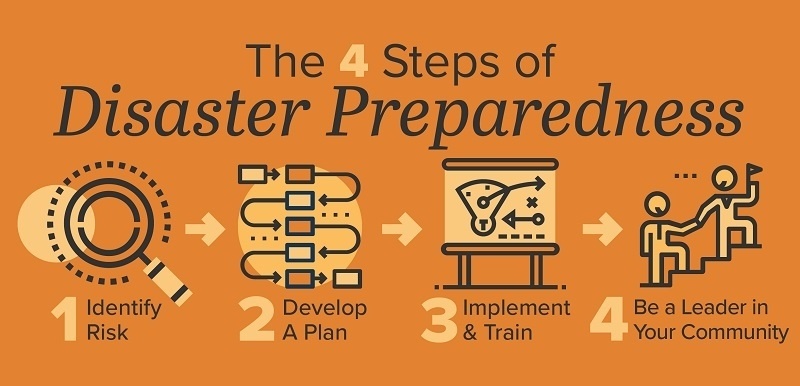

- Small Business Insurance Property Loss and Commercial Insurance Risk – There has been an unexpected rise nationally of natural disaster cases and subsequent claims in the United States over the last 2 years. Damages from natural disasters have caused an increase in the costs of the premium for most of the small business commercial insurance involving property nationwide.

The best way to manage long term rate increases, and avoiding much of the rate increases caused by temporary increases in algorithmic table function is to work with one specific long-term broker who may be able to maintain your current pricing, based on continuing long term relationship with the insurer.

- Small Business Commercial Insurance to Cover Increased Risk due to Cyber and Data Security Risks and Commercial Insurance Risk – – It has been widely publicized that cases of cyber-attacks are escalating in the United States, causing substantial financial loss to some companies and catastrophic losses to others. Hackers are now able to access people’s sensitive information, which can result in lawsuits against the small business even though the small business has no direct involvement in the exposure.

Cyber attacks have become a matter of daily concern, not a rare occurrence, and data breach in small businesses are now very common, and no business is immune to a prospective breach of data. For a Small Business to have complete coverage from catastrophic loss, it must consider cyber coverage for common tactics used by hackers. This coverage has become affordable recently due to the number of businesses buying this optional coverage. A Cyber Coverage Clause will help small businesses protect their employees and assets as well.

- Employment Practices Liability in a Changing World; Small Business Commercial Insurance Policy’s Must be Addressed to Cover New Eventualities and Commercial Insurance Risk– It is hard to turn on TV or read a newspaper without hearing of new harassment allegations by employees against their employers. The news reports the allegations against a person, but that person is an employee, an employee of a company, that company is the one at risk.This trend is actually expected to increase over the foreseeable future, which may lead to higher deductibles in small business commercial insurance rates. The time is not to review harassment coverage within your policy and ensure it is sufficient. Then with your long-term insurance broker, lock in your rate as long as possible to pre-empt any rate increases for as long as possible.

Do you have a small business with small business commercial insurance, one that may involve commercial insurance risk? Have you sat down with an agent and really reviewed these issues in the last year, how about the last few years? Many have not reviewed or even considered any of these issues to be of concern to Small Business, but Commercial Insurance is important, and in 2020 they risk will affect your rates and coverage even more.

Call Riles and Allen today for a free no-obligation consultation, let them review your policies, make sure you are protected in 2020. You know, we may even be able to lower your overall rate, best of all we are available to sit down one on one and discuss your situation. Riles and Allen, serving Florida and all the needs of Small Business Commercial Insurance. Riles and Allen is a General Agent, so we can discuss any policy and find you the coverage that fits your small business best.