Importance of Good Home Inventory is Key to Smooth Homeowners Insurance Claim When Disaster Strikes

Why a Good Home Inventory is Key to a Smooth Insurance Claim after a Storm, Fire, Theft or Disaster

The time to make a home inventory is before your property becomes lost belongings, not the day after a storm or fire. The time to list what was stolen from you is not the day after your home was robbed. A thorough home inventory is essential to a smooth claim process with your insurance company.

We hear so often that part of an insurance claim is not covered, or that the claim is being ignored. Insurance companies will usually pay claims reasonably quickly and satisfy the claimant if the proper records are kept. Unfortunately, your word that items existed before a fire or a flood are not necessarily proof that they did.

So how do you protect yourself and your family and provide the insurance company with all the data they need to properly satisfy your claim in a timely manner? It takes some time and record keeping, but it is worth the effort.

Another advantage of a thorough review of your in-home belongings, is that it will point out items that may requite additional insurance. Some are high value, such as jewelry and collectables. These must be handled in a separate rider and appraised for their true value. It is best to understand this reality before a disaster than discover an item or collection is not partially or completely covered after an event causes you to make a claim.

Personal Inventory Insurance Means and Method

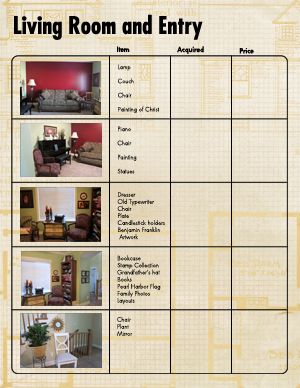

In a claim process, the insurance company will want to know beyond a general description what items have been lost. The claim representative is will want to work with you but may not accept and pay based on a claim of “everything in the living room” without some proof of the contents.

During a time of crisis, it’s extremely difficult for a home owner to fully remember the various pieces and items that were lost in that living room. Documenting via an inventory and keeping records like sales receipts and copies of important legal papers is a great way to prove to an insurance company the extent of the loss.

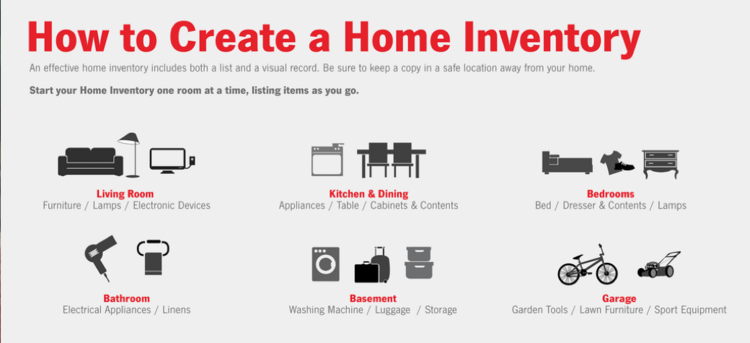

While creating an inventory may sound daunting, the process is easier than it looks. In many cases, the task can be done simply by walking through the apartment or home and making a list on a personal device, notepad, pictures or videos. Some even recommend documenting online so the inventory can be accessed from anywhere.

A good plan that really works is to make a note of each item of substantial value with a short description and a picture or two of those items. Some items – like expensive jewelry, collectables or firearms – may require more detailed descriptions, and appraisal and additional coverage on the policy if the value is over your policy limits. I think you can agree; there would be questions if you simply put on a claim that you had a comic book collection worth $3,000.00 with no picture records and no appraisal proving its value.

Knowing the scope and value of possessions will help home-owner’s insurance policyholders better determine the amount of coverage they need. The following list is a great practice for both recording and accounting for possessions and valuables, before disaster strikes:

Here’s how to catalog your most prized possessions.

1) Make A Game Plan

When you do a home inventory, you’re documenting an entire life’s worth of valuables. You don’t need to finish the task in one day. Dedicate a couple hours each week to go through your home, so you don’t get overwhelmed or overlook something because you’re in a hurry.

2) Make A Checklist

Pull out your possessions from the attic, garage, safe, drawers, and closets. Dig up your receipts and warranty information, too. As you go room by room, make a list of everything you own that you would want replaced in case of burglary or natural disaster.

Note: Insurance cannot replace sentimental value. Though your wedding pictures, awards and personal memorabilia are important to you, they will not be covered for the value they have to you. Put simply, there is no way to replace personal pictures from 10 or 20 years earlier and an album of 20 year old photos that has very little monetary value. Best to take care to protect those items as best you can.

Here’s what your list might include:

-

Electronics: computers, laptops, tablets, cameras, TVs, video game consoles, stereo equipment, movie and music collections

-

Appliances: office equipment, power tools, kitchen appliances, washer, dryer

-

Indoor and outdoor furniture, dishes, silverware, cookware

-

Your yard, garden, and outdoor structures

-

Your wardrobe, especially designer clothing or family heirlooms

-

Artwork

-

Antiques

-

Jewelry, especially anything that’s been handed down to you

-

Your medicine cabinet

-

Collections: artwork, guns, coins, silverware, stamps Hobby equipment: musical instruments, boats, kayaks, weights, golf clubs

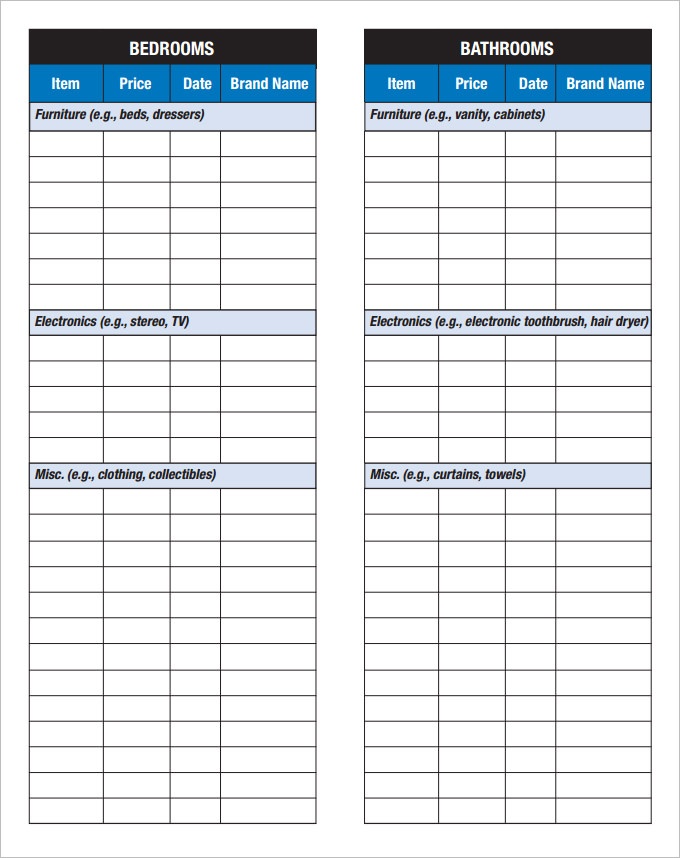

When you list each valuable, include its price, brand name, model, size, unique features, and where you bought it.

Unless you have antique silverware or high-end clothing, you don’t need to catalog everything in your wardrobe or kitchen drawers. Lay out your less expensive items, and take photos of them in groups. Then count each piece of silverware, dishware, and clothing item, and estimate their total value.

For example:

22 short sleeve shirts 400.00

10 dress slacks 200.00

3 dress suits 600.00

Various underwear and socks 300.00

2 winter coats 200.00

2 sweaters 100.00

Then include several photographs illustrating the above to show their # and condition.

3) Take Video

Do a video walk-through of your home. Go through each room, including the closets, attic, basement, garage, and backyard, and narrate the video as if you’re giving your insurer a guided tour. The more evidence you can give of what’s in your home, the more likely you are to be compensated for what you have lost.

4) Take Photos

After you record video footage, take photos of each valuable item you own and have listed above. Take a close-up of their serial numbers, manufacturer’s tags, receipts, warranties, and appraisals. When you create your checklist, write down their price and any unique features they have.

The items we are talking about are things such as:

- Flat Screen TV

- Blue Ray Player

- Nice Piece of Furniture

- Computers and Components

- Appliances of Value

- Art

- In Fact, just about anything individually listed

5) Download An App to Organize all Your Data

Once you’ve documented your assets, you’ll probably have hundreds of photos to organize. Download a home inventory software or app. These programs let you store and label your photos, type a description of each photo, scan barcodes, estimate a total sum of your assets, and manage your checklist of valuables. They also let you export your photos and documentation as a PDF file, so you can easily save, print, and share your checklist with your insurer or your family members.

KnowYourStuff, Encircle, and Nest Egg are three of many free inventory apps. Insurance companies also have apps that are free to download, whether or not you buy a homeowners policy through them.

6) Store Your Inventory in A Safe Place

You can always document your valuables the old-fashioned way, by printing out your records and storing them in a file cabinet. Just beware that those hard copies won’t do much good if your home gets flooded, or a fire reduces them to ash.

No matter how you decide to catalog your valuables, you need to save your inventory list in more than one spot. Print out multiple hard copies, and you could even give them to trusted friends or relatives.

You could organize your records on your computer desktop, and save them to a thumb drive or data CD. Give that thumb drive or data CD to your relative, lock it in your safe deposit box, or send it by email to yourself so it stays within your system even if the computer is destroyed in a disaster. If you use an app, download your inventory as a PDF file, and email that PDF to yourself, or use thumb drive or data CD to get to a relative in the same way.

*Remember that if you save anything online, you need a secure password to protect the sensitive information you store.

Double-Check That Your Homeowners Policy Covers ALL Your Valuables

When you search for homeowners insurance, don’t choose a policy based solely on price. If you opt for the cheapest, most basic plan, you also get minimal coverage for your valuables. If you have personal items that are worth much more than what your plan pays for, add personal property insurance to your existing homeowners policy.

Personal Property Insurance or a Rider for collectables will help cover the replacement cost of those personal items you couldn’t stand to lose. Only a proper review of your policy with a complete inventory of your household items with your agent can assure you are properly covered.

Why not call Riles Allen Insurance Agency today for a no cost review of your Homeowners policy. Let us review your Homeowners policy and see if you are getting the best coverage for the pest premium possible in your specific situation.

Don’t Give Up Your Valuables for Good

Seeing your most prized possessions get lost or damaged is upsetting enough. When you file a claim to replace them, you want the process to be as simple and hassle-free as possible.

Don’t rely on your memory as your record-keeper. Create a home inventory checklist, and you can recover your most precious valuables in a much smoother and more timely basis.

Let Riles and Allen help you every step of the way with all your insurance needs;